By Olivier Duguet

The recent oil prices slump represents a unique opportunity for South East Asia to move towards energy price transparency by cutting expensive energy subsidy programmes which have been around for decades.

The Paris-based International Energy Agency (IEA) estimates the global cost of subsidising energy consumption (mainly in developing economies) is US$500 billion a year.

Current cheaper oil should reduce this bill to about US$400 billion a year, leaving governments with the choice of continuing oil, gas and electricity subsidies to encourage consumption or dismantle these very costly programmes for national budgets and restore economic fairness.

The choice is particularly important for South East Asia’s high growth and fuel dependant economies.

Energy demand from ASEAN’s 600 million inhabitants has risen two and a half times since 1990 and is now equivalent to three quarter of the energy demand of India.

Indonesia alone spent US$29.2 billion in 2013 to make fossil fuels cheaper for final consumers.

Total subsidies from three other ASEAN countries - Vietnam, Thailand and Malaysia – amounted to over US$10 billion for 2013, according to IEA’s World Energy Report.

The electricity support schemes have in return required subsidies of power generation fuels to keep state-owned utilities financially viable.

The difference between market and subsidised prices, which accounted for 2.16% of the GDP in ASEAN-5, has contributed to major imbalances in many countries and banned utilities to invest in new technologies and capacity building.

In 2012, the US$51 billion spent by ASEAN countries in subsidising fossil fuels was equivalent to 11% of all general government budgets in the region.

Vietnam, amongst others, has electricity prices capped and differentiated for different users. More than US$2.5 billion is spent yearly to subsidise electricity prices from national utility EVN, distorting any competitive advantage renewable energy sources could have in a sun and wind resourceful country.

Indonesia, under its new President, has just started to slash its fuel subsidies but is still artificially reducing the price of 60 to 75 million tonnes a year of coal used in its 12 GW of coal-fired power plants.

Thailand spent US$6.8 billion in 2012 in fossil fuel consumption support schemes, second only to Indonesia, according to IEA records.

Low income earners have to be protected against wild gyrations of fuel prices of course, but giving consumers the good price signal is crucial for the future of renewables.

The current plunge of oil prices will be one of the very last chances to implement true energy prices around South East Asia and enable renewables to compete directly with non-subsidised fuels.

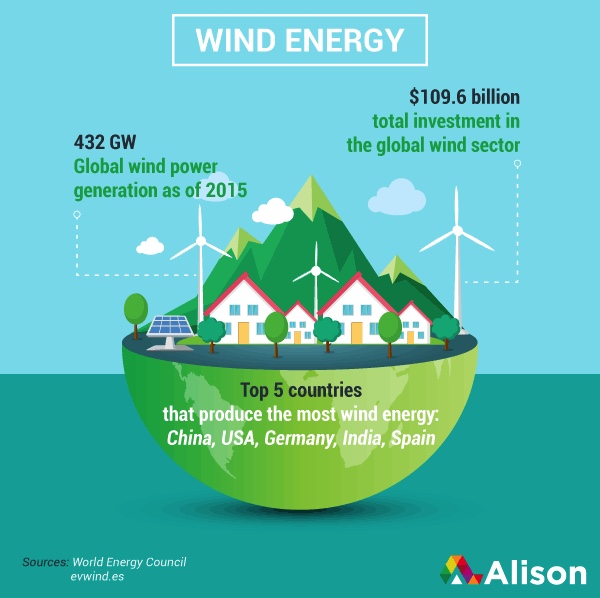

Wind resources, even though not evenly distributed in the region, are the most cost competitive and easy to deploy of today’s renewable energy sources.

Recent economic weaknesses in China, Europe and Japan, coupled with market share war amongst oil producers, have pushed fuel prices to unexpected lows which may not last long before world economic growth resumes.

Bringing back energy prices transparency is what renewable power needs to thrive in a future low carbon world.